By Ian Arden & Nathan Kay

Crypto Winter offers outstanding opportunities for family offices, private investors and funds to move from sideline observers, to blockchain sector investors. There are many promising blockchain projects that check all the boxes for a great value proposition, brilliant team, and growing community support and traction, but they may be currently financially distressed. A smart investor with a lifeline can be a win-win for a promising project at exactly the right time. No doubt, investors have heard of a number of VC firms like Binance Labs that braved 2018’s Crypto Winter cycle and achieved 1,000 percent or more returns. But how do you avoid pitfalls when choosing the right strategy to get started, and the right crypto startup investments that meet your portfolio’s objectives?

As experienced blockchain company builders, investors and also advisors, we’ve been working in this sector since the early days, as early as 2010, so we’ve been through crypto winters before. Applicature is our blockchain venture builder and accelerator founded in 2017; we’ve worked with over 300 projects and invested in many of them since then. Mempool Ventures is our Crypto VC and advisory firm built on the success and returns we achieved first through Applicature. We’d like to share some insight on the current state of the blockchain during 2022’s Crypto Winter and how we got here. Then we’d like to share some tips on the most effective investment approaches for the experienced private investor or fund new to blockchain sector investing.

Analyzing Crypto Winter’s Cold Winds

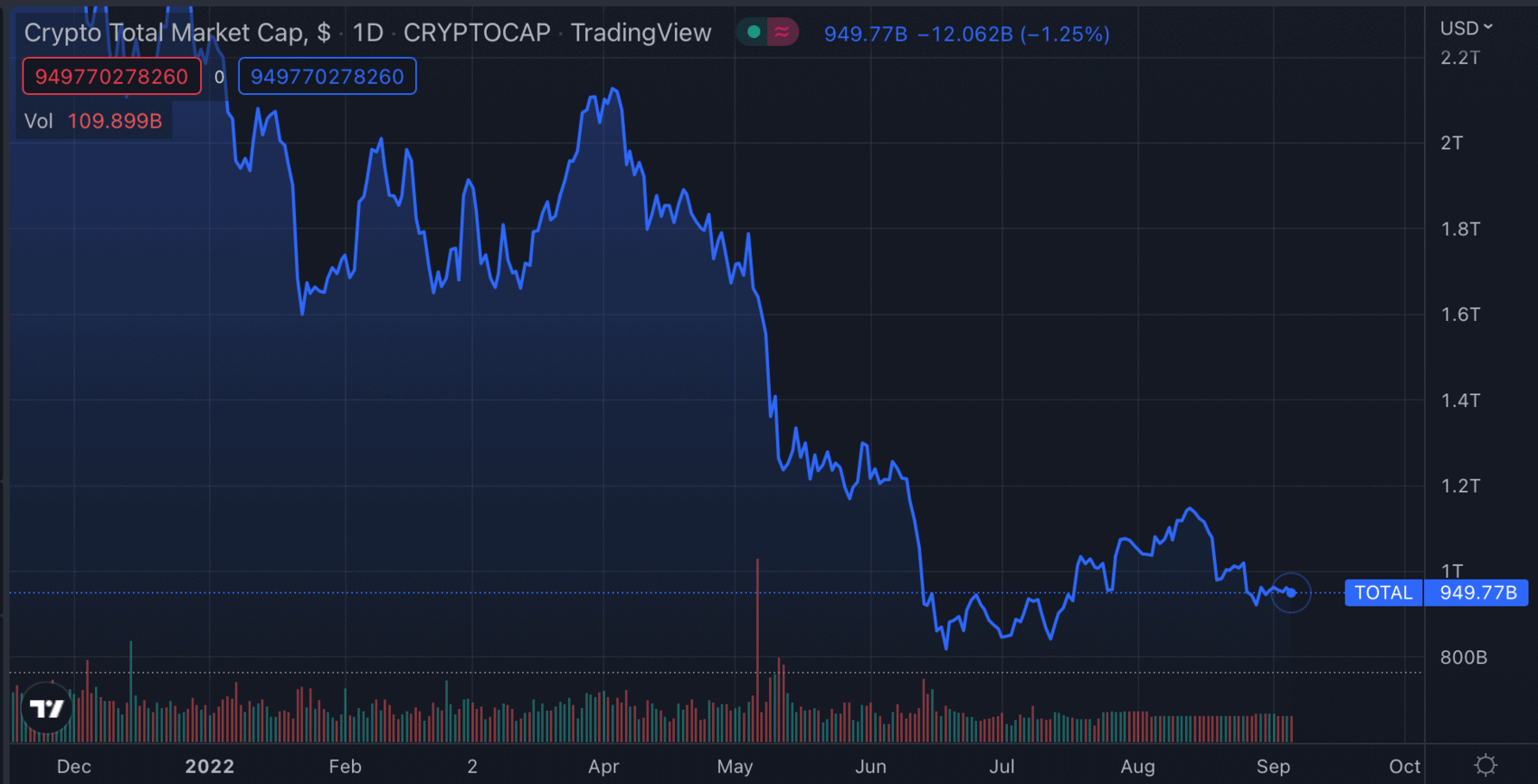

For most of 2022, crypto prices, which can serve as a proxy for the health of the industry, have been in a stage of a protracted correction. The major altcoins lost up to 90% of their all-time highs, while Bitcoin tested the $17.7k level.

On a macroeconomic front, inflation rates are at historic highs, so we’ve seen the US Federal Reserve pursue an aggressive monetary policy withdrawing billions of liquidity from the markets. The war in Ukraine and sanctions against Russia have destroyed large supply chains and created an energy crisis.

All these factors have led to challenges for ordinary investors and institutions alike, and we’ve seen organizations in the sector facing debt obligations and bankruptcy. Consumer crypto services firm, Celsius, was just one company put in a difficult position looking for additional funding to avoid the worst fallout of the crypto winter and ultimately succumbed to failing. Mining companies are facing some huge losses. The expected income from BTC mining has shrunk to 39% of normal.

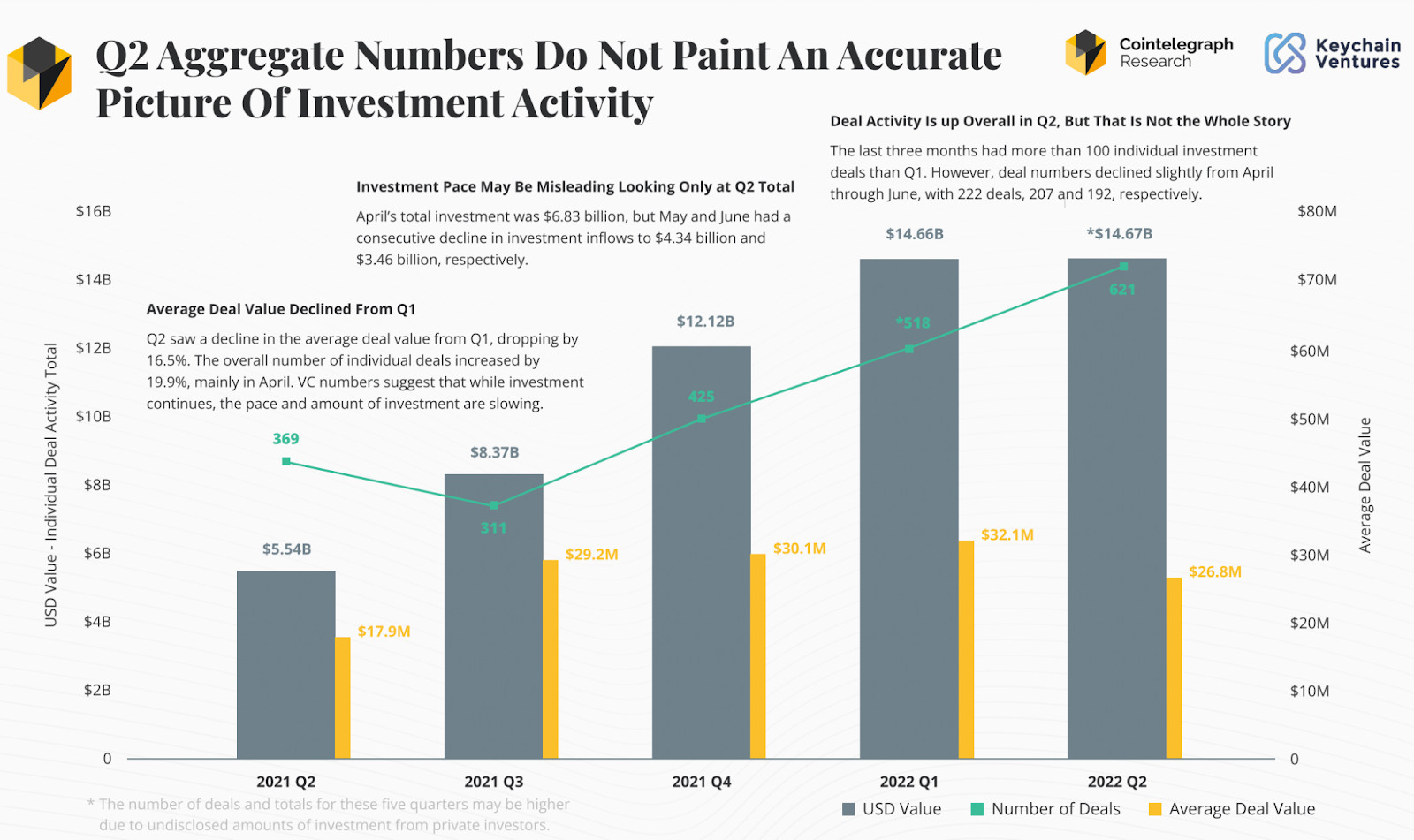

Venture Capital funding remained very strong to the end of Q1 even as we saw Q2 register a correction. Blockchain sectors such as gaming and metaverse started attracting record breaking investment sums as the top sectors. However, many VC investors switched to a more conservative holding pattern, but many are also looking for new ideas and projects that can be positioned for growth as we come out of the crypto winter.

Venture investment volumes fell in Q2 2022, except for several key sectors of the crypto industry. Judging by the geopolitical and economic situation in the United States, the case will not change in the coming months. The aggressive monetary policy of the Fed and the reduction of balance sheets negatively affect the stock and crypto markets. Accordingly, the liquidity crisis will not disappear in the coming months, but it does not mean that there are not unique opportunities at this current stage.

Here’s some tips for family offices, private investors or funds to put on your winter boots and trudge into the snow leveraging the opportunities of Crypto Winter.

Tips to Transition into Blockchain Investments

Get help with your education process– it’s not “voodoo”. However, it can take a while to understand how decentralized networks work, the technology layers and tokenomics behind the blockchain ecosystem, and the business drivers of growth which can be nuanced and quite different from the hierarchical and centralized version you are familiar with.

- Clearly articulate your interest in blockchain and approach to investment strategy development. Truly understand what your long term interest in crypto is, or should be, considering your current businesses/investments and any specific personal or educational interests also. Understand the future fit with your current portfolio i.e. if retail and ecommerce is your focus, then consider acquisitions with a focus on immersive ecommerce, Metaverse and Web3 to help you get in front of future trends.

- Find an experienced blockchain industry partner to work with to help you not only articulate the right strategy, but also pick the right investments. They need to know where to look and have existing relationships and industry contacts to expedite putting your requirements into action.

- Get blockchain-specific expertise to help with research/acquisitions for due diligence, valuation, tech evaluation, community research, audit etc. You’ll need a partner that knows how to value these companies, how token economics works, and sensitivity analysis/decision making for assessing the short term and long term.

- For post deals, get acceleration help particularly if salvation, turn-around, and reactivation are part of your plan for an acquired company. You’ll need know-how to get this plan into action and accelerated. You’ll need executional and operational know-how in the sales, marketing, development, audit, community building, business development etc. to jumpstart growth again.

- Exit plan execution might come sooner than you think, so be ready. Blockchain moves very fast- your horizon till a liquidity event/market inflection point might be shorter than you are used to. What should exit look like and when? Have the expertise you need to plan in advance so you are ready and prepared when this opportunity knocks.

Crypto Winter is not as bad a period as it sounds; it is a time of innovation, re-grouping and opportunity. An investment thesis leveraging the crypto winter can get family offices, funds or other private investors into the sector at a good point in the cycle. You can leverage future appreciation stemming from the fast growth and inevitable blockchain and decentralized networks transformation, and the adoption that is already underway. Last Crypto Winter- we at Applicature knew about Avve, currently a top liquidity protocol project, and other Layer 1 solutions that are leading companies today. Fantom is a Layer 1 success story we were watching- the VCs that joined them last Crypto Winter made very healthy returns. We didn’t act on many opportunities and we won’t do that again.

It’s easy to make the mistake of focusing time doubling down on existing companies/investments, rather than focusing on what to do to optimize capital and resources with new opportunities at a really opportune time. We’ve learned from this which helps us be a great value-add partner today. When good, promising projects suffer from a liquidity crisis- there are unique opportunities for investors to add a lifeline and benefit with large returns when more favorable conditions and demand returns. As this sector is truly here for the long term–you can be sure the sunshine of summer will return again bringing a better environment for traction and growth.

About Mempool Ventures

Mempool Ventures is our Crypto VC firm that provides investment to a growing portfolio of companies in gaming, web3, metaverse, Defi, health and other sectors of blockchain. We invest in early-stage crypto projects at the genesis stage and also provide acceleration and mentorship help. Our advisory services include research, education, strategy, due diligence and tokenomics analysis for sophisticated investors and funds. Contact us for information on Crypto Winter investment strategies and adding blockchain sector investments to your fund.

Mar 11, 25, Weekly: Crypto Rollercoaster – Bitcoin Dips, Trump’s Crypto Summit, and HUD’s Blockchain Experiment

Mar 11, 25, Weekly: Crypto Rollercoaster – Bitcoin Dips, Trump’s Crypto Summit, and HUD’s Blockchain Experiment