Nowadays, crowdfunding is a very popular means of fundraising within the crypto community. One of its most common and profitable ways to crowdfund is an ICO launch, which is designed to engage capital to a project.

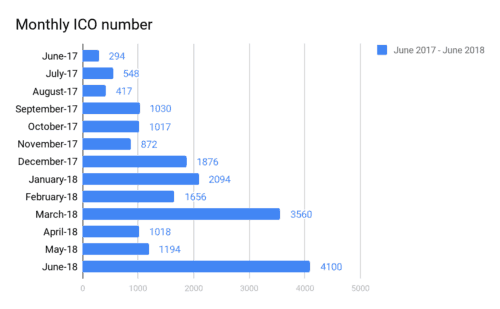

The number of crowdfunding projects is growing every day on the world market. Here is a comparison of the number of ICOs launched between June 2017 and June 2018:

For dishonest ICOs, the competition is just too big and many of them are resorting to fraud and setting goals they are unlikely to actually achieve. We can call these scam ICOs.

While ICOs, in general, are a multi-billion dollar field, they are unregulated, so scam ICOs are not something you’ll see just once. When we look at lists of recently-launched initial coin offerings, it becomes really hard to come up with reasonable filters to distinguish between a scam and a real ICO.

The main problems, with the exception of projects whose team planned to just run an ICO and flee with the contributions, are:

- There is no real business and no need for the ICO as a funding mechanism; nor are there instructions for its further development.

- Blockchain is not applied to a real business.

This is why it is extremely important to learn how to distinguish all indicators of scam ICOs in order to avoid getting trapped by ICOs that do not guarantee data security, the validity of financial transactions, or protection against unpleasant accidents.

One needs deep, expert knowledge in order to define whether or not an ICO is a scam. People are creative when it comes to scams.

Here are 4 basic types of scam ICOs and their identifying features, which will actually help you distinguish them from the others and avoid wasting time, money, and resources.

Let’s observe the possible scenarios:

1. The Company Has No Value At All

A company that cannot offer its customers something valuable in their field of interest, but instead encourages them to invest their money in an ICO that is likely to be unsuccessful, will not bring profit to investors. This will definitely be a trap for anyone who joins the campaign.

A lack of real components is a direct signal indicating that a project is a scam. ICOs should include:

- a well-elaborated idea

- a product that a crowd will follow

- minimalist structure

- blockchain application

- token economics

- a white paper

- an experienced team

- a technical roadmap

- a plan of action

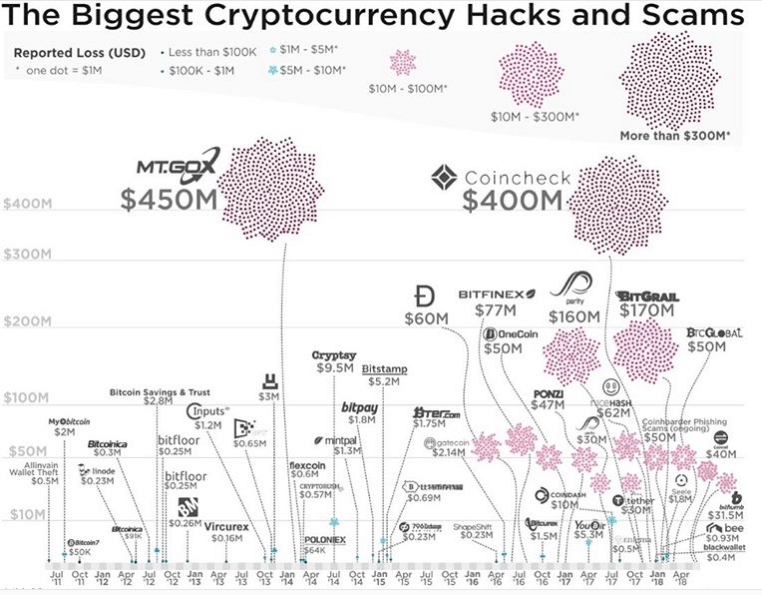

Here’s a graphic presenting the biggest cryptocurrency hacks and scams in the world:

You should also consider this list of mistakes that result in a negative impact on ICO outcomes.

If a company doesn’t provide the above-mentioned components for successful ICO operation, it is not worth paying attention to at all.

2. Blockchain Is Not Applied

The first thing one should discover when considering a white paper is whether it predicts potential means of overcoming challenges that blockchain does guarantee.

First, blockchain is a digital database that provides access to shared, replicated, synchronized data that is visible to all participants in a block in the form of a token.

A smart contract is a helpful means of ensuring the credibility of agreements. Consider their main benefits for investors:

| Feature | Description |

|---|---|

| Accuracy | It can record all details of the terms and conditions of each completed transaction. |

| Trust basis | Transparency, autonomy, and security ensure the credibility of all agreements. |

| Transparency | All records are available and accessible to each participant in the block. |

| Speed | Smart contracts exclude the necessity of manual work, speeding up all processes. |

| Security | Smart contracts provide the highest level of data encryption, ensuring the security of all data. |

| Savings | There is no need for intermediaries or middlemen. |

| No paperwork | Long, boring operations are not a problem anymore, as smart contracts are based on computer work. |

| Efficiency | Greater speed means better results and the growth of token value. |

| Data storage | All data is public and stored in one place. In case of data loss, smart contracts are easily retrievable. |

| Clear communication | Miscommunication and misinterpretation are not possible within the system. This can also increase the level of efficiency. |

Blockchain use cases are increasing, leaving no doubt that they are worth applying to businesses in any field. Check out blockchain use cases for proof that it provides a great number of solutions for every industry to succeed.

If there are still third parties (intermediaries) in the solution, this is no place for blockchain application. Blockchain offers a payment system without financial intermediaries to make transactions practically non-reversible. This decreases transaction costs and make micropayments possible.

The second type of scam ICOs includes companies that don’t involve blockchain technology in their work processes.

3. Gaps in White-Paper Development

At this stage, ICO founders pay a lot of attention to ICO development by providing a detailed description of their project in a white paper. Collect information on the company’s supporters, and discover the solution it is going to bring to the global market.

Find out whether a company has a realistic, comprehensive plan of application — for example, a well-written white paper.

Community Support

Attracting a constantly increasing pool of potential contributors from all over the world is possible if the company plans intelligently and has the right people on board. Here is the meaning of community support: the more supporters a company has, the more credible it appears in comparison with competitors, and the greater its chances of raising a lot of money.

It is recommended that you find out whether or not a company receives funding from other supporters, and if so, how it can affect company obligations.

Another thing worth paying attention to is who the owners of a company are, and what amount of stake they have. Nowadays, one of the most common reasons for company failure is a conflict of interest among stakeholders, and nobody knows which working scenario will be followed later if a company undergoes a change of position.

Technical and Financial Description

Many ICOs facilitate their work processes with a white paper, which provides a full description of the existing technology or technology under development. A well-written white paper should contain the following key elements:

The Location and Contact Information of the Company

At least 32% of ICOs cannot be identified as an entity; therefore, investors can’t find out their origin, location, or the information about the founders.

This makes it difficult to understand the rules and legal protections afforded to them. Moreover, investors are provided with options in case of fraud, theft, or loss.

If a company doesn’t note a verifiable geographical location and presents itself for fundraising activity, it is obviously a scam.

Vision, Mission, and Target Goals

A successful company has to stand out from the crowd of millions of others, so it should have its own idea, a great vision, and a global mission that can unite different people all over the world around one goal. An ICO with significant potential and really professional developers never makes very big promises, but just describes the opportunities it offers. Moreover, no experienced developer would ever make a prediction about the token price.

Promises are not suitable when it comes to business, as no one knows exactly what is going to happen later.

Information About the Product

The product should be valuable, unique, and worth paying attention to — and of course, a good deal.

The Existing Problem and the Solution Offered by the Company

Investors should make sure the application is able to solve a particular problem that actually exists, and they should know how people will benefit from their investment.

It is also important to monitor and analyze competitors’ markets to find out if there are any other companies trying to solve the same problem. They might have a better solution.

Token Description

There are a lot of different types of tokens, all with unique qualitative and economic features. Information on the intended use of the issued coins, their quantity, details on when and how reserved coins can be held, the possibility of liquidation, and all purchase terms must be mentioned in the white paper.

If a token doesn’t have multi-signature escrow policies, or the entity approves the transactions, the cash suddenly disappears. Such features are a direct sign of scam ICOs.

The white paper should provide all necessary information about the token standard. For example, if we are talking about a platform on top of Ethereum, we should define the type of token to be used for the ICO and for actual platform operational flow. As you can see, Ethereum now provides a pretty wide list of standards that can be used:

- ERC-20 is commonly used on the Ethereum platform. Users faced some problems with it, so other standards are improved versions of it.

- ERC-223, in contrast to ERC-20, provides the “tokenFallback” function, which may also be used as the “approve” function. This allows the receiving contract to decline the tokens or implement other actions.

- With ERC-621, users can benefit from two additional functions:“increaseSupply” and “decreaseSupply,” which can increase and decrease token supply accordingly. They can also change the amount of the token supply.

- ERC-721 offers a non-fungible token, which means that each token is absolutely unique and has different value for different users.

- ERC-827 provides token transfer and approval by the owner for later spending by a third party.

Each of these has its own set of features and legal rights, which can have different meanings for typical holders.

Additional required steps for listing a token on a regulated exchange or alternative trading system (ATS) should be included in the white paper, as well.

Team Professionalism

When talking about the team presenting the company to potential investors, beginners or unqualified members are not people who can earn credibility in the project. Therefore, the relevant experience of previous success cases is an indicator of the quality of management and professional approach to work. An ideal team should consist of professionals in every field: content, editing, marketing and PR, SMM, community, design, code, and targeting. Moreover, all data concerning engineering experience, skills, qualifications, and other relevant attributes should be highlighted. A high number of links to recent successful projects is one more sign that a company is not a scam.

One more piece of advice is to study the profiles of company representatives on social networks. Contact them, and ask some curious questions. Also, find feedback on forums to get insights into people’s opinions about the company. Identify ICO team members and check them by monitoring their accounts. Define whether or not team members are committed to achieving success, or if this is just one more new project because ICOs are trendy today.

Industry Risk Factors

There are a lot of cases of successful ICOs that could collapse or be fully modified later, creating unstable conditions for token-holders because they may be surprised by another intended use. To fix this, it is necessary to check for an available alpha version of the product and find out whether a token-holder has the ability to take part in conferences, meetings, and events to be informed of all new updates. There should also be access to valuable partnerships, and a detailed roadmap with clear milestones.

Information like potential vulnerability to hacking, data loss, and disruption, and legal issues (for example, privacy concerns and data portability across borders) is worth mentioning. Be aware of all possible risks for the future.

It is not a secret that financial issues are most important for investors. The underlying technological solution is paramount, so there should be a simple description of the technical problem and the solution.

A good sign is a code published on a public code repository like Github, allowing potential investors to check whether or not it is well-developed. Moreover, their repository might be impressive, lacking, or private. This is very important information, too. If a company doesn’t provide links to code, or if it is just a clone with a few changes, this is a true indicator of a scam ICO.

We need here Blockchain Architecture section

- Which blockchain solution is to be used, and why?

- Analysis of different solutions

- Technical description of the platform

- Smart-contract applicability and description

- Use-case description

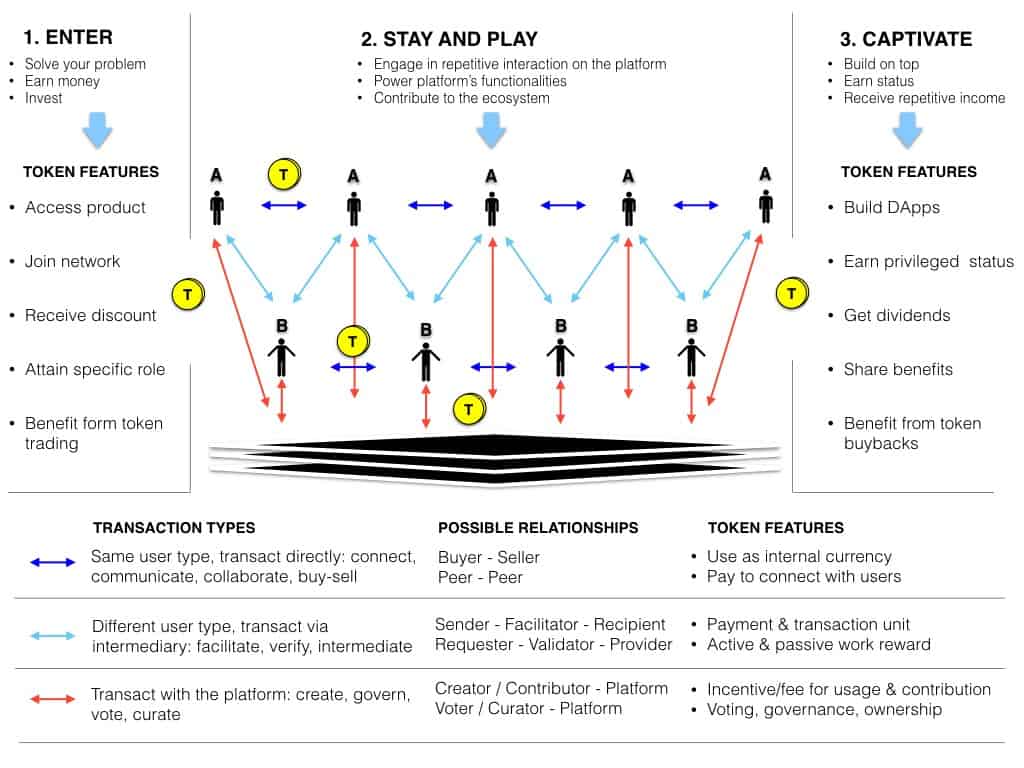

Token Economics Applicability

Because an ICO launch is based upon the release of tokens, blockchain application is a ‘must-do’ step, as tokens must be decentralized in order to ensure efficient processes. Such an approach facilitates the current financial system and makes shares and trading decentralized. With DD engagement in the platform environment, token circulation can be carried out in a more appropriate way.

Token economics plays a great role in investors’ lives, as the income and benefits a company promises depend upon the quality level of its development. Let’s define the factors investors should consider first:

- How fees for transactions will be paid (will this be included in the token, or not)?

- Does the token provide access to a product, give interaction rights to it, or grant the right of ownership to a value?

- Does the token offer the opportunity to govern — for example, the right to vote or to have an impact on decision-making and/or the development of a new product or service?

- Is there the possibility to add value to the token in the network or relevant market, or to receive rewards for active work?

- Does the user have access to additional value through sharing or disclosing certain data about tokens?

- Is the company going to sell or buy any parts of the token?

- Does the token serve as a security deposit, a principal payment unit, or the principal accounting unit to buy and sell things, or is it needed to join a network or any related entity?

- Does a designated blockchain autonomously distribute profits and other benefits to token-holders?

- If the token is claimed as a utility, does the project have any business strategies to prevent project cash-flow gaps due to the volatility of tokens and crypto?

However, if the white paper is full of the repeated buzzwords with no practical meaning, no matter how qualitative it is, then this is definitely a scam.

4. Excellent Preparation Is Nothing Without Practical Meaning

Having all the must-have points for a good ICO covered is great, but the following information, shows real value and should be mentioned, too:

- how the company will actually build a blockchain solution

- how much money they need

- timelines (roadmap and business plan with the description of MVP stage development)

A commonly-faced pitfall for all investors is that a company may have a well-written white paper, which, in practice, indicates no understanding of the practical plan of implementation. This is another reason for calling an ICO a scam. Marketing budgets, well-thought-out branding, great intro videos, and SEO wizards help involve potential investors and get their money.

Hyperbole is an endemic problem that buyers and sellers can face while reading a white paper. So be ready that not everything you will read is the truth.

In practice, more than 90 percent of ICOs fail, especially while there is a technological risk, and this is absolutely normal. Another interesting fact that all investors should remember is that 90–95% of ICOs won’t have any value in 3 years, regardless of whether it is a scam or not.

| Country | Raised USD mn | Closed ICOs | Unclosed ICOs |

|---|---|---|---|

| USA | 1,722 | 87 | 40 |

| Switzerland | 1,462 | 33 | 1 |

| Singapore | 641 | 35 | 13 |

| Russia | 438 | 57 | 43 |

| China | 306 | 14 | 2 |

| U.K. | 275 | 26 | 23 |

| Japan | 195 | 6 | 6 |

| Canada | 163 | 10 | 5 |

| Cayman Islands | 162 | 3 | 0 |

Analyze in detail all available information about a company in order to draw the right conclusion for further cooperation. Pay attention to the details of the roadmap and the approach the company follows in order to understand what it is going to do to implement all of its outlined goals.

Remember that attractive, promising “to-do lists” are not a basis for an unconditional belief that the company can really do everything, especially under deadlines.

To sum up, cryptocurrency is shaping the future of the world financial system, and scam ICOs are just a temporary emergency that the crypto community is trying to eradicate in order to protect itself from undesirable consequences.

Whether you are just a beginner or an experienced investor, be wise and cautious. Thoroughly analyze each offering, because deep research is a vital element of the investment process that a lot of investors overlook when assessing ICOs.

How Does EOS Crypto Work?

How Does EOS Crypto Work?

What Is Token Economics?

What Is Token Economics?

Bitcoin Investment Funds

Bitcoin Investment Funds

Blockchain Education: a Should-Have or a Must-Have?

Blockchain Education: a Should-Have or a Must-Have?

It looks like AXenS has finished their ICO and disappeared. Website over a month ago and already out of date, no contact information on the contacts page, no news on them at all. Looks like a scam ICO–and one promoted by Applicature.