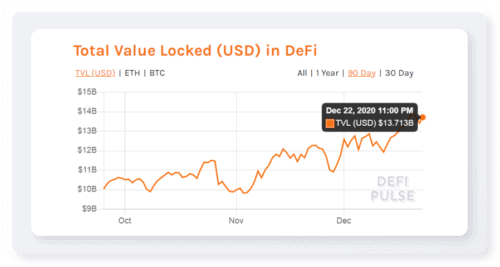

Over the past years, Decentralized finance (DeFi) has risen to become a widely accepted use case in the crypto ecosystem. DeFi is a financial software built on the blockchain and makes financial transactions more open and accessible. Many of these blockchain platforms are built on a single network and maintained through collaborative efforts.

More recently, Polkadot’s technology is further disrupting this booming ecosystem by helping to connect multiple specialized blockchain platforms into a single network. At Applicature, a DeFi development company, our team has all it takes to give you a secure connection of different platforms on Polkadot with blockchain for decentralized finance.

DeFi and Polkadot

Polkadot offers an impressive ecosystem with a design that allows it to be scalable and operable across platforms. The purpose of Polkadot is to allow blockchain networks to enhance scalability, optimize themselves for specific use cases, work and collaborate, self-govern, and upgrade without the need for complex processes.

Staking and lending

Staking and lending of decentralized platforms are easier and faster to access unlike what obtains in traditional banks. Polkadot is a key supporter of staking on their platform. Polkadot has gained attention for staking, with more than $2.5 billion worth of DOT tokens at stake. Polkadot is the largest network by staking value, DOT has generated a positive return in the U.S. dollar, bitcoin, and ether over the first 90 days of trading of the token when it was launched by the network.

When it comes to lending, DeFi protocols permit users to lend or borrow in a completely decentralized way. It gives an individual complete control over their assets at all times. By using smart contracts that operate on open blockchain solutions such as Ethereum this process becomes automated and reduces the complexities associated with getting collaterals like processing personal data through a central authority.

How does the Liquidity pool work on DeFi Exchanges (Dex)?

A DEX has two features that make this process possible:

- Liquidity Mining

Liquidity Mining is needed to determine market prices. This ensures the input of two trading pairs by independent liquidity miners. This is necessary because:

- There is no order book

- There is no matching,

- No price list,

- The systems are always centralized and vulnerable.

- These liquidity miners put money into the system to get Liquidity Mining Rewards.

- Decentralized Exchanging/Swapping

The decentralized exchanging/swapping is similar to Liquidity Mining – with the big difference that you don’t have to input a pair, but one a single cryptocurrency.

However, there are 3 types of risks with a DEX.

- Smart Contract: There is a possibility of exploiting a bug in the code of the Smart Contract.

- Project Risk: This has to do with the validity and security of the projects.

- Impermanent Loss: The third and often most complex risk is that of an impermanent loss which may develop if you were to withdraw your liquidity from the pool before a specified time.

What Defi projects can you do in the Polkadot ecosystem?

Our Defi developers have identified some useful DeFi protocols that enhance the value in Polkadot’s blocks. In our DeFi development agency, you can hire a DeFi developer with excellent knowledge of Polkadot’s technology. We have Polkadot security auditors who will ensure the quality and security of your platforms are intact.

Three key components of the DeFi stack make them useful and vital in the ecosystem. When you hire defi developers, this technology allows them to launch a defi project and build high-end applications. They are:

The Application Layer – The user interface

The Protocol Layer – a set of defined rules

The Base Layer – how assets and data are recorded on the blockchain. This network protocol allows arbitrary data to be transferred across diverse blockchain frameworks.

Polkadot has become the ‘blockchain of blockchains’. Polkadot is an interoperable ecosystem on its own. Our experts are already using Substrate, composed of various components to build useful tools on this platform. Just like what Applicature did with DeFi with a backdrop of blockchain integration services and tools we can build a DeFi Network on Polkadot using the Relay Chain, parachains, parathreads, and bridges. Together, using these elements we form a developer’s framework to create interoperable decentralized applications (dApps) harnessing the liquidity of Ethereum.

Let’s take a look at some typical DeFi protocols that have contributed to the increased value in Polkadot’s blocks. Polkadot’s technology positions them as important components of the ecosystem.

Polkaswap

Polkaswap is a DeFi Exchange created uniquely for the Polkadot framework using the SORA v2 network. It gives security, liquidity, convenience, and a user-friendly UX, where an instant exchange of blockchain assets can take place.

This is similar to the Uniswap on Polkadot, a DEX that allows users to set up multiple liquidity sources. Also, it makes cross-chain swap possible, which is ideal for the Polkadot ecosystem offering transfer charges that are lower than Ethereum.

Users can yield farm PSWAP, Polkaswap’s token and it allows users to create liquidity on token trading pairs in the Polkaswap DEX platform.

ChainX

This community-driven project is built on the next-generation blockchain framework substrate, it has a token called PCX, and it is the largest Layer-2 network of Bitcoin backed by smart contracts.

It removes the barriers between blockchain assets and creates a public chain ecosystem for integrating multiple currencies. It makes it possible to transfer ETH, BTC, EOS, or DOT across various blockchains.

The market value of BTC, DOT, ETH, ERC20, EOS, and other assets depends on their users’ mining power, the amount deposited by an inter-chain bridge.

Akropolis

Akropolis is aiming to build economies that are decentralized and autonomous in its community. It has a token AKRO and gives the basic tools for DAO creation, staking, borrowing, and lending.

It has successfully integrated with some of the best DeFi projects on Ethereum like Compound, dYdX, MakerDAO, Fulcrum, Aave, and Curve.

It has plans to integrate a fiat gateway, where users can effortlessly fund their wallets using a credit card. In the future, it will support many stablecoins like USDT, USDC, and TUSD.

MANTRA DAO

MANTRA DAO is also a community-governed DeFi platform with an OM token that allows holders to engage in key decisions and get rewarded for their contributions. This platform focuses on staking, lending, and governance.

MANTRA DAO effortlessly supports non-custodial staking using the Polkadot ecosystem assets. It allows users to access $DOT & $KSM staking through MANTRA DAO.

ChainLink

The ChainLink with its “LINK” token is a leading decentralized data oracles network. This platform provides the needed connection between smart contracts and the inputs and outputs necessary.

This is an important addition to the DeFi sector because its data oracles are integrated with almost all Ethereum-based DeFi projects. This link accounts for its profit during the recent DeFi boom with its token LINK’s market cap surpassing $3B, ranking highly among other similar tokens.

Chainlink was integrated with Polkadot in February 2020 and became the primary provider of decentralized data oracles facility to parachains on the Polkadot network.

DeFi projects in Polkadot are not just about repeating existing concepts but generating new ideas altogether. We’re heading into interesting times as more and more teams are building DeFi on Polkadot, they are combining creativity with highly scalable and composable systems. We look forward to a promising future as talented teams expand the use cases for what’s obtainable today and create new, novel products for the market.

If you need an expert Parachain on Polkadot development company, get in touch with us. If you’re interested in the solidity developer defi, check out our services. Learn more through our blog and join in the conversation.

Decentralized Finance Development: Revolutionize your Blockchain Project

Decentralized Finance Development: Revolutionize your Blockchain Project

Get a Loan of This: How DeFi Disrupts Lending & Borrowing

Get a Loan of This: How DeFi Disrupts Lending & Borrowing

Mar 11, 25, Weekly: Crypto Rollercoaster – Bitcoin Dips, Trump’s Crypto Summit, and HUD’s Blockchain Experiment

Mar 11, 25, Weekly: Crypto Rollercoaster – Bitcoin Dips, Trump’s Crypto Summit, and HUD’s Blockchain Experiment