Decentralized finance or DeFi has gained significant attention in the year 2020. DeFi now defines the Ethereum blockchain with Defi tokens such as Uniswap, creating large ripples in the crypto markets and reaching all-time highs. Most Decentralized finance projects hosted on the Ethereum blockchain run via Decentralized applications or DApps. In this article, we look at the best DeFiDApps making waves in the blockchain ecosystem.

What Are Decentralized Applications?

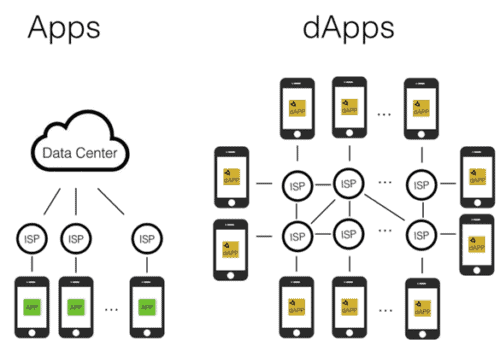

Decentralized applications or dApps are digital applications or software programs created to run on a blockchain like Ethereum or a Peer-to-Peer network of computers instead of a single computer, making many people carry out its control and management in a decentralized manner. In essence, the control is not in the hand of a single authority. Unlike web-based applications, they don’t require a centralized database to function effectively.

The dApps are designed for diverse real-world use cases. Although the UX of dApps may look similar to that of web applications, their backend processes are entirely different. DApps use decentralized servers for transactions in a distributed and peer-to-peer fashion instead of using the central HTTP protocol to interact. dApps utilize smart contract protocols on wallet software for instant transactions in an automated manner.

Smart contracts are the critical element of dApp technology. These automated, self-executing contracts facilitate instant transactions between two people in a seamless, quick, and secure way. They help to create powerful software applications which are useful in different industries.

Web Applications versus Decentralized Applications Explained

A conventional web application like Facebook, Uber, or Twitter runs on a computer system owned and operated by an individual organization, having complete authority over the app and its functioning. There may be multiple users on one side, but a single organization controls the backend.

Source: Towards Data Science

For example, when you open Facebook on your internet browser, the feed on display is extracted from data held on the company’s web server. DApps, in contrast, run on a P2P or a blockchain network.

For instance, BitTorrent, Tor, and Popcorn Time are apps that run on computer servers that are part of a P2P network chain, where many members are using content, feeding or seeding content, or simultaneously performing both functions.

This design implies that web-based app creators or owners can easily modify the contents or users. On the other hand, the creators or company cannot control a dApp working on a blockchain.

On the back end, dApps interact with their corresponding blockchain networks through a “wallet.”Wallets serve as a means of personal identification and authentication for managing your blockchain address; instead of using the HTTP protocol, as is the case in internet apps, DApps trigger smart contracts on the blockchain to execute transactions. Distributed network nodes on the blockchain validate dApp data instead of company servers.

Features of a DApp

- It has to be open source without any entity owning a majority token.

- Changes to the network protocol must be decided by consensus among the users of the network.

- The dApps data is stored on a decentralized Blockchain platform

- DApps must generate tokens as proof of value.

- Generated dApp tokens should be distributed as rewards for contributing to the network growth.

Many cryptocurrencies satisfy these criteria even without a smart contract and can be considered dApps. They have their own blockchain or build on top of another dApp like many DApps on the Ethereum blockchain.

As an example, the Bitcoin blockchain fits the criteria as a dApp because:

- No single entity owns the majority of the circulating bitcoin, and it operates on open source code.

- The Proof of Work (PoW) consensus mechanism guides its governance.

- All Bitcoin data are stored on the blockchain.

- Bitcoin generates tokens resulting from the mining process that act as proof of value.

- Miners receive bitcoin cryptocurrency as a mining reward.

DeFiDApp Development

Development of a DeFidApp is a process that leads to the generation of an app that offers distinct features such as secure Peer-to-Peer transactions, user anonymity management, transparency, and fast trade throughput.

There are diverse protocols to consider before building a Dapp or launching a DeFiDapp to expand your business.

DeFi Development Company

Applicature, the premier DeFiDApp Development company, brings to you the expertise, experience, and technological tools needed to launch a DeFiDApp project for your business successfully. Our DeFi Developers offer you DeFi based solutions that function over the distributed ledger. Our blockchain marketing companywillpromote your DeFi projects or tokenization platform. Below is a list of some of our DeFiDapp Development Solutions that our DeFi services will support.

- Stablecoins

- Decentralized Finances

- Crowdfunding

- Lending And Borrowing Platforms

- Yield Farming

- Liquidity Mining

- Betting

- Insurances

- Prediction Markets

- Money Legos

- Wrapped Bitcoin (WBTC)

Benefits Of Dapps

Transaction Speed: Smart contracts are the bedrock of Dapps; hence they run with speed and do not face shutdowns due to network failure or maintenance.

Privacy: Access to Dapps does not require identity information making it safe for people. Users can open an account using Pseudonyms.

Complete data integrity: The data is immutable and indisputable. It is a public ledger stored on smart contracts, making it impossible to forge transaction data.

Dapps are decentralized – All decentralized applications are distributed, meaning they’re pretty hard to shut down. They are censorship-resistant due to the open-source governance and immutability of the blockchain.

Complete transparency –Decentralized Applications eliminate intermediary applications like payment gateways, making the transfer of funds easy and quick.

Permissionless-DeFi allows anyone to create and launch a Dapp to a global audience.

Interoperability- All Dapps are interoperable, meaning that a Dapp can be built on another using a single source code. This concept is referred to as Money Legos.

Some DeFiDapps Use Cases

MakerDAO

Source:Cryptoknowmics

Many people regard MakerDao, the permissionless lending platform, and the DAI creator as the first DeFi project. It has often been considered the “Godzilla of DeFi,” suggesting it has been around as old as Ethereum itself. It has long since held the number one position for ranking on virtually all DeFi platforms when it comes to the total amount of ether (ETH) locked within the system.

It is a lending platform where users can borrow the stablecoin DAI, which is pegged to the US dollar by staking digital assets like ETH as collateral. The platform’s decentralization is key to its success as a lending platform. Also, all lendings are automated by smart contracts meaning there is no human interference or credit rating in securing a specific loan.

The DAI uses cryptocurrencies such as ETH, some Ethereum-based ERC-20 tokens, or BAT as collateral. The Cryptos are locked up until the user is ready to repay the loan and incurred fees. Once this condition is satisfied, their locked up ETH is released. In case there is a drop in ETH price, it is liquidated, and the proceeds are used to pay the borrowed DAI and any penalties. This process brings stability to the governance of the MakerDao system.

Uniswap

UniswapDeFiDApp is an automated token exchange platform for swapping ERC-20 assets. It is also used to liquidity-mine for specific projects. Even though there are impermanent losses, the return is not that bad.

Uniswap was launched in the US in 2018 to reduce entry barriers to financial markets by easing the decentralized finance ecosystem’s joining process.

Uniswap is not entirely flawless; its decentralized nature means anyone can list a token without a review process, making it possible for scammers to create a token using a popular DeFi platform name and misleading users into buying worthless tokens. To address this issue, Uniswap introduced kists to establish the legitimacy and reputation of tokens in August 2020.

Another drawback is the high network fees occasioned by congestion on the Ethereum chain. However, compared to its other DeFi exchange competitors, it offers better options for the best asset liquidity, zero listing fees, no native tokens, and a relatively cheap gas fee.

Finally, Uniswap is open-source and permissionless, making it possible for users to create an ERC market corresponding to the amount of Ethereum they possess. This feature makes project owners fix a base price for their tokens easily. Unisawap is the most utilized Decentralized finance exchange currently on the market.

Compound

Compound is a decentralized lending and borrowing platform created by Compound Labs Inc. in September 2018. This platform is built on the Ethereum blockchain. Compound was originally a centralized application during its launch.

However, it later released its governance asset – COMP, making it an open-source, decentralized autonomous organization (DAO). Compound allows users to use their crypto assets for lending and borrowing 9 Ethereum-based assets.

Compound uses the native cTokens that allows users to deposit ETH and get cETH in return. The same concept applies to deposits made in USDT, giving cUSDT in return. This mechanism makes it easy for users to track the value of their lent assets and the accrued interests.

Compound Labs recently released a white paper that outlines the Compound Chain, a stand-alone distributed ledger connecting assets and value across various blockchain platforms, including Ethereum, Polkadot, Tezos, and others.

Aave

Aave is a borrowing and lending platform built on the Ethereum blockchain. This DApp allows users to lend their assets and receive interest by doing so. All that is required for this to be possible is simply connecting their Ethereum wallet to the DApp.

Unlike other similar DApps, Aave stands out because it incorporates additional features such as flash loans. Flash loans are valid for a single blockchain transaction, making them ideal for debt without collateral.

How is that achieved? This possibility is achieved because the transaction is reversible at any time if there is no repayment of the loan. Smart contract pools provide the assets used for flash loans. The interest rate on flash loans on Aave is only 0.30% which is very low.

Also, Flash loans provide arbitrage opportunities for traders to get a loan, make an arbitrage trade, and then pay back the loan with the accrued interest.

Yearn Finance (YFI)

Yearn Finance has rapidly grown to become a popular decentralized Finance DApp after its launch in July 2020. It functions as a yield aggregator that does all the yield farming work for its users. It performs an automated search for DeFiDApps that offers the best yield returns on the Ethereum blockchain.

The YFI token’s price rose considerably after its launch, rising from $739 in July and reaching more than $43,000 by September. Analysts suggest that this price increase reflects the confidence people in the DeFi ecosystem have in Yearn Finance and the platform’s expanding range of products.

Their primary product is the vaults, a place where users can deposit their cryptocurrency and earn rewards on them over a space of time. Vault’s algorithm for getting yields is more complex than that of the initial original product Earn, hence the birth of a new term yEarn.

Synthetix

This decentralized platform runs on the Ethereum blockchain. It creates Synths which are on-chain synthetic assets that help in tracking the value of the real-world asset.

Synthetix was born as a stable coins project Havven, which later rebranded and diversified its scope before it was launched on the Mainnet in early 2019. The Synthetix platform supports more than 20 Synths representing fiat currencies, trading commodities such as gold, and crypto-assets. In the future, it plans to incorporate Indices, Stocks, and other derivatives.

OpenSea

Even though OpenSea may not be the most significant DeFi application in the crypto market, it has become unarguably the largest marketplace for crypto collectibles. It is a decentralized marketplace with more than 30,000 users who can globally buy, sell, trade, or exchange items.

Trading on OpenSea is backed by smart contracts, which are automated and devoid of control by a central authority that can hold your items; users effortlessly save their items in their chosen wallet.

Augur

This DApp is marketed as “your global, no limit betting platform.’

Augur allows users to participate in real-world events like sports, elections, and economics. Its initial coin offering (ICO) in 2015 successfully raised 100,000 ETH and 2,000 BTC.

The Augur uses the tradable token known as Reputation (REP), which can be used to place a bet, dispute bet outcome or purchase a bet participation tokens. Reputation (REP) is a perfect name for the token; they can be bought or received for reporting or being right about a disputed bet.

The creators of Augur intend to use this platform to bring solutions to the “crisis” in the betting ecosystem, where users get their betting limits lowered and their accounts closed abruptly. Such action becomes impossible on the Augur platform, being a decentralized peer-to-peer platform.

Zapper

Zapper is a decentralized finance platform for managing your DeFi assets and liabilities in a straightforward interface. It has an excellent dashboard that makes it easy to monitor your digital assets on your wallets or used in other DApps. Their three key features are Monitoring, investing(Zap), and management. The monitor allows you to get an overview of your assets, Zap will enable you to invest in unique opportunities across multiple DeFi platforms, and the management tool gives you control over your assets between DeFi platforms.

Newdex

Newdex is the first DEX platform on the EOS blockchain. It is the most popular EOS DApp by volume as of December 2020. This DAp also works on the TRON blockchain.

Like the other DEXes, Newdex is a decentralized platform and does not require KYC or have direct access to your funds. It also offers a wide variety of EOS trading pairs available to trade and side chains, including BOS and TLOS.

This DAppleverages the enhanced scalability of EOS over Ethereum to gain an advantage in terms of transactions per second (TPS), which is the number of transactions a blockchain network processes in a second.

However, the implementation of Ethereum 2.0 will bridge the transaction speed difference. Notwithstanding, Newdex remains an excellent alternative for users looking away from Ethereum.

Final Words

Decentralized applications (DApps) offer many benefits for businesses and individuals. It is fast, efficient, secure, easy to maintain, and keeps your business running globally. Many DeFiDApps are bringing positive solutions to the blockchain ecosystem on platforms like Ethereum, EOS, and many others.

Today, by using Applicature’sDeFiDapp Development Services, we will help you develop and launch your Decentralized Application or Dapp and gain access into an expanding DeFi ecosystem. As a solidity DeFi developer and blockchain developer, our services, experience and knowledge span over several years. We can build innovative Dapps that are unparalleled and guaranteed to bring success to your business venture. Don’t hesitate to send us an email or a phone call to schedule a consultation to discuss your projects.

Mar 11, 25, Weekly: Crypto Rollercoaster – Bitcoin Dips, Trump’s Crypto Summit, and HUD’s Blockchain Experiment

Mar 11, 25, Weekly: Crypto Rollercoaster – Bitcoin Dips, Trump’s Crypto Summit, and HUD’s Blockchain Experiment