Introduction to NFT

NFT this, NFT that, what exactly is NFT, and how can you benefit from this blockchain innovation? Let’s find out more in this article as we explain the details of NFT and share some practical uses. Remember to follow our blog; you will definitely find exciting ideas beautifully explained on our platforms if you are new here.

What exactly is a Non-fungible Token (NFT)?

Irreplaceable, non-fungible tokens or NFT cryptos are encrypted assets on the blockchain with a unique identification code and metadata to distinguish them from others. They are different from cryptocurrencies because they cannot be equivalently traded or exchanged. These tokens are different from commonly used fungible tokens, such as cryptocurrencies, which are similar to one another and can be used as a medium of exchange for commercial transactions.

That’s where Applicature comes in to perform wonders in the blockchain ecosystem by designing safe and secure platforms and managing your projects professionally. Our blockchain developers have the talent and technical know-how to develop fantastic NFT tools for your assets.

What are the Characteristics of NFTs?

- NFT is the only encrypted token that exists on the blockchain and cannot be reproduced.

- NFT can be used to represent real-world assets such as artworks and real estate.

- By “tokenizing” these tangible assets in the real world, assets can be purchased, sold, and traded more effectively while reducing the possibility of fraud.

- NFT can also be used to denote people’s identity, property rights, and so on.

How do NFTs Work?

The unique structures of each NFT make them useful for multiple use cases. For example, they are ideal tools for digitally representing tangible assets such as real estate and artworks. Because NFTs are stored on a blockchain, they can also be used for identity management or to connect artists with audiences, thus removing intermediaries. NFT can eliminate intermediaries, make transactions straightforward and create new opportunities and markets.

Value of NFT tokens

NFT is making headlines with the volume of transactions it has facilitated. Here are a few non-fungible tokens’ examples of the disruptive changes it has brought to a thriving blockchain ecosystem:

- In March’s early days, a batch of Beeple NFT was sold for more than $69 million.

- This auction set a precedent and set a record for the most expensive digital artwork ever sold.

- This work is a collage containing pieces from the previous 5,000 days of Beeple.

NFT for art, music, video, sports

Most of the current NFT market revolves around collectables, such as digital art, sports cards, and rare items.

The NBA Top Shot is mainly becoming the most hyped space because it allows the collection of irreplaceable tokenized NBA moments in the form of digital cards. A few of these cards have been auctioned for millions of dollars. More recently, the CEO of Twitter, Jack Dorsey, made a tweet with a link to a tokenized version of the first-ever tweet, in which he wrote: “Set my twttr.” The first tweet of the NFT version has been bid to $2.5 million.

Is the NFT a bubble on the blockchain?

Non-fungible tokens are becoming the new crypto of the blockchain, and many are asking, is this just a bubble on the blockchain or a real opportunity to own tangible assets? The truth, in a way, seems to be that NFTs might be a bubble waiting to pop, but Crypto art platforms are in it for the long term.

One primary concern about the evolving NFT artwork market is the availability of a secondary market. Even though many people are buying and selling NFTs, others are skeptical about losing their money due to the non-availability of a secondary market.

Today, few secondary markets are emerging as people can resell their initially purchased items. If you bought an NFT for a personal reason rather than a store of value, the bubble might not affect you at all. As for an investor, this might imply that a lot of value is ultimately lost in their purchased asset.

Like every financial market leverages people’s collective belief, the NFT craze is also a speculative market on Ethereum. The real winners in this NFT craze may not be NFT speculators but the tech companies and software enabling speculations. Ether, for example, is profiting from its widespread use in NFT transactions, which gives a new use case application for the cryptocurrency. In the end, like every investment has risks, the same applies to NFTs.

Understanding Non-fungible Tokens NFTs

Like physical currencies, cryptocurrencies are fungible; that is, they can be traded or exchanged with each other. For instance, one bitcoin is always equal in value to another bitcoin. Furthermore, 1 unit of Ethereum is always equal to another 1 unit. This fungibility attribute makes cryptocurrency suitable for use as a secure means of transaction in the digital economy.

NFT brings a paradigm shift to crypto by making each token unique and irreplaceable so that an NFT cannot be equal to another. As digital copies of assets, they are similar to digital passports because each token carries a unique, non-transferable identification code that differentiates it from any other token. They are also extensible, meaning you can merge one NFT with another NFT to “breed” a third unique NFT.

Just like Bitcoin, NFT also carries ownership details to facilitate easy identification and exchange between token holders. The owner can also add metadata or attributes related to the asset in the NFT. For example, tokens representing cocoa beans can be categorized as fair trade. Alternatively, the artist can use his own signature in the metadata to sign his own digital work.

NFT evolved from the ERC-721 standard. The ERC-721 was developed by the same person responsible for the ERC-20 smart contract, and it defines the minimum interface requirements such as ownership details, security, and metadata required to exchange and share gaming tokens. The ERC-1155 standard further promotes this development concept by lowering the cost of transaction and storage needed by NFTs and allowing the processing of multiple types of non-fungible tokens in batches into a single contract.

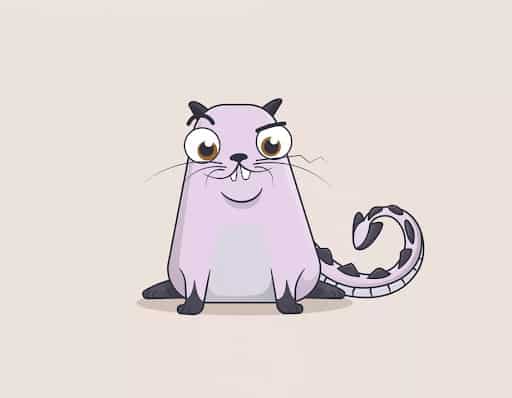

History of NFT: CryptoKitties

Perhaps the most well-known use case of NFT is CryptoKitties. The encrypted cat was launched in November 2017 as a digital representation of cats and has a unique identity on the Ethereum blockchain. Each cat is distinct and has a different price in Ethereum. They reproduce each other and produce new offspring, which have different qualities and values than their parents. CryptoKitties attracted many fans in only a few weeks after its launch, with people spending $20 million worth of non-fungible tokens Ethereum to buy, feed, and raise them. Some enthusiasts even paid more than $100,000 for this.

Although the CryptoKitties use case sounds trivial, subsequent non-fungible tokens use cases will have more meaningful business impacts. As an example, an NFT use case has been implemented in private equity and real estate transactions. One of the outcomes of enabling multiple types of tokens in a contract is that it permits the provision of escrow services for different kinds of NFTs, from artwork to real estate or even a single financial transaction.

Why are non-fungible tokens important?

Non-fungible tokens are a development of the relatively simple idea of cryptocurrency. The modern financial system consists of a complex transaction and loan system, suitable for different asset types, from real estate to loan contracts to art. By enabling the digital representation of physical assets, NFT has taken a step in the positive direction in reshaping this infrastructure.

To be sure, the concept of digital representation of physical assets is neither new nor the use of unique identification. However, this concept will become a powerful force for change when uniquely combined with the advantages of the tamper-proof blockchain of smart contracts.

Arguably, the most apparent benefit of NFT is that it brings market efficiency. Converting tangible assets to digital assets can simplify the process and eliminate intermediaries. NFTs representing digital or physical artwork on the blockchain eliminates the need for agents and allows a direct connection between artists and the audience. They can also improve and simplify business processes. For example, the NFT of a wine bottle will make it more comfortable for different supply chain participants to interact with it and help track its origin, production, and sales throughout the process. Ernst & Young, consulting company, has developed this type of solution for one of its clients.

Irreplaceable tokens are also very suitable for identity management. Consider the need to show a physical passport at each entry and exit point. By converting each passport to NFT, each passport has its own unique identifying characteristics, which can simplify the immigration process in different territories. Extending this use case, NFT can also be used for identity management in the digital realm.

NFTs can also democratize investment by decentralizing tangible assets such as real estate. It is a lot easier to break down digital real estate assets among multiple owners than a physical structure. The ethics of tokenization is not limited to real estate; it can be extended to other assets, such as artwork. Therefore, the painting need not always have one owner. Its digital equivalent can have many owners, and each owner is responsible for a small portion of the painting. Such an arrangement can increase its value and profit.

The most unique possibility of NFT lies in the generation of new markets and forms of investment. Consider a real estate divided into multiple parts, each of which contains different characteristics and attribute types. One of the districts may be close to the beach, the other district is the entertainment center, and another district is the residential area. Based on its characteristics, each portion of land is unique, the price is different, and it is expressed in NFT. The complex and bureaucratic process of real estate transactions can be simplified by incorporating relevant metadata into each unique NFT.

Applicature, a blockchain marketing company, has the expertise to implement such an NFT concept. As NFT becomes more complex and integrated into the financial infrastructure, it is possible to realize the same blockchain tokenization platform around tangible assets like land and artwork in the real world. We are always a call, chat, or an email away; contact us and let us handle your blockchain projects.

4 Secrets to Building a Successful Crypto Company

4 Secrets to Building a Successful Crypto Company

NFT Marketplace on Blockchain can be a Promising investment choice

NFT Marketplace on Blockchain can be a Promising investment choice

Migrating projects to Binance Smart Chain (BSC)

Migrating projects to Binance Smart Chain (BSC)

Tokenization Platform: What Is It And How Does It Work?

Tokenization Platform: What Is It And How Does It Work?