The consequences of blockchain introduction into the fintech industry are still difficult to assess. But now, this technology has a significant impact on the liquidity and turnover of many asset classes, thereby eliminating the intermediary and bringing transparency to the industry. The tokenization platform plays a vital role in the propagation of crypto. Let’s figure out what it is and how it works?

What is Tokenization?

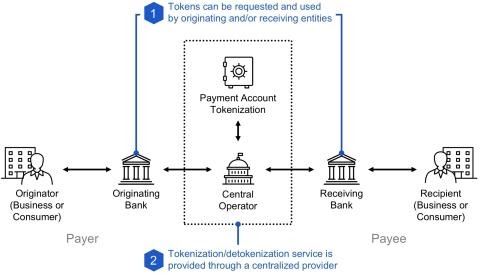

As of today, the main instrument for representing physical assets is securities, such as stocks, bonds, checks, etc. With the proliferation of blockchain technology, a powerful new tool has emerged to convert the rights of a physical asset into a digital token. The name of this process is tokenization. Tokenization allows you to convert the rights of a physical asset into a digital token. The main advantages of this method over traditional trading in securities are trading speed, transparency, and security.

The last two points are provided by using the blockchain:

After the tokenization process, the resulting tokens can be traded in the secondary market, which facilitates the trading of physical assets, allows the cost of indivisible assets to be shared, and ensures the safety and transparency of all related processes.

Also, tokenization allows for increased liquidity of assets by reducing the threshold for entering the market and the minimum transaction amount. An important feature of tokenization is the ability to share the value of indivisible assets (such as real estate, art, etc.), which will attract investors with little capital and will make it easier to benefit from initially expensive and illiquid assets.

Purpose of Tokenization

Why is tokenization becoming such a popular topic? Because it implies the creation of a holistic infrastructure, with the ability to audit, exchange, and connect third parties. All these operations will be much cheaper than using traditional infrastructures. Due to tokenization companies, investing has become cheaper, faster, safer, and more accessible. All of this creates opportunities for users who previously encountered financial or geographic constraints to invest in assets. They will have an alternative to traditional and, by and large, outdated investment methods.

Since tokenization takes place using the blockchain, companies can introduce a new asset management system that can increase liquidity, provide the ability to manage assets to all participants, and even apply sharing scenarios. It can also more efficiently integrate such components of the traditional securities market as a depository, a stock exchange, a clearinghouse, and software.

Tokenization began to be used in various industries as a method of making payments that does not require the transfer of any confidential information and personal data. This is accomplished by sending data as a sequence of characters that lose value outside of a strictly defined context. Thus, it endows such tokens with security and safety characteristics. The arrival in 2015 of a new digital asset – Ether – opened up new horizons for tokens, expanding the range of their use.

What Can You Tokenize?

You can tokenize any class of assets, both illiquid and liquid – stocks, debt instruments, metals, intellectual property, real estate, etc. Tokenization can be applied by businesses to simplify accounting and settlements, as well as by government institutions to automate processes. There is the opinion that if everything is tokenized, the world will turn into one huge stock exchange.

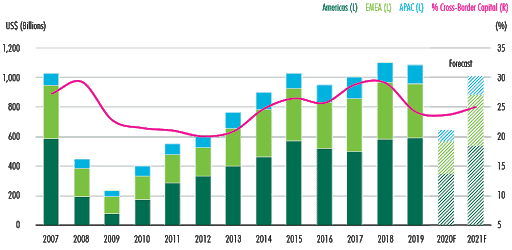

Real estate tokenization is the most exciting area of blockchain projects. Real estate tokenization companies will translate the economic value of the real estate market into a more liquid form.

Note: The real estate market remains the most attractive target for investors. Take a look at the investment volume graph below:

Real estate prices are quite stable, so the value of tokens backed by real estate is of volatility like ordinary crypto assets. It will increase the capitalization of the transfer of the equivalent of the value of the real estate; it will not be affected by crypto-economics; and it will increase the efficiency of ownership of real estate by involving unused resources in the economic turnover.

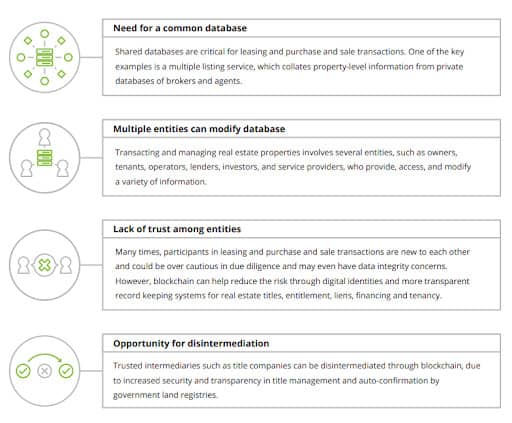

Consider the following reasons to use blockchain in real estate sale transactions:

Real estate tokenization companies are not the only ones to conquer the world of digitized assets. Well-known tools for tokenizing natural assets are stablecoins and security tokens. At the moment, this is the most logical step in the development of blockchain technology. It will allow you to move from speculation on highly volatile cryptocurrencies to ensuring the accelerated development of the economic sector through new instruments that are not available on the classic market.

Tokenization Platforms

The advent of blockchain technology has given impetus to the creation of many other new technologies and services. One of them is a tokenization platform.

The tokenization platform is built to tokenize real-world assets. It connects authorized investors with trusted companies. Tokenizing securities simplifies, speeds up, and fundamentally modernizes the traditional marketplace, thereby making the trading life of investors comfortable, productive, and cost-effective.

Tokenization platform provides:

- Utility/security token issuance services through smart contract creation;

- A secure investing superintendence system that incorporates a digital wallet, custody, and crypto debit cards for comprehensive asset management;

- Decentralized exchange services for trading tokenized assets; and

- Access to a far-reaching collection of tokenized assets.

The tokenization platform has advantages over traditional instruments: tokens are easy to issue and liquid. They quickly circulate without a centralized ledger, and they ultimately allow investment transactions to be secured with real assets.

Linking Tokens to Collateral

In the simplest version of tokens tied to a certain product, the security is guaranteed by the company that stores the real product and performs the function of cashing the token. But there are also more complex variants of tokens, the value of which is determined at the level of the accounting system itself. For example, tokens are calculated and awarded for certain user actions within the platform itself. Then the provision of tokens is guaranteed by a consensus mechanism by which the state of the database (blockchain) is validated.

Tokenization Platform Advantages

The main advantage of tokenization is that tokens can be fully used within the environment of their use, but are completely useless outside of it. Tokenization is ideal for protecting sensitive data such as credit card numbers, social security numbers, and any other data that attackers regularly steal for use or sale on the black market. If attackers fail to hack into the tokenization server itself in order to obtain real data associated with tokens, then the stolen tokens will not give them any opportunity to use them.

A Tokenization platform provides the following benefits:

- Compliance with legal regulations

- Programmable securities

- Elevated liquidity

- 24/7 market availability

- Fractionalization of property

- No intermediaries

- Cost-efficiency

- Transparency

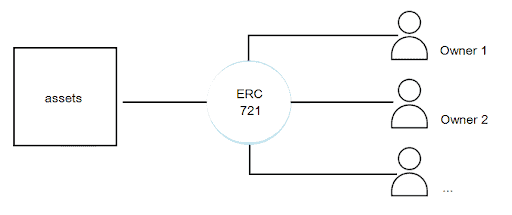

Tokenization companies can create a uniquely identifiable token that is associated with a given asset – the Ethereum ERC721 token. This token can then be split and sold to different owners.

A Tokenization platform must include a well-oiled system of software modules:

- Role management (users and system administrators)

- Token lifecycle management (issue, withdrawal from circulation, etc.)

- Security management

- Integration with KYC/AML systems

- Integration with payment systems

- Management of commissions, limits, events

- Mobile and web applications

- Exchange module or modules for integration with external exchanges

Final Word

Tokenization companies will simplify the sale and purchase of assets, as well as provide security, transparency and increase the speed of transactions with assets. On the other hand, tokenization, although not illegal, is outside the current legal norms and standards, and it is also not regulated by the laws of most countries of the world. At the moment, when creating tokenization platforms, one ironically negates the advantages of blockchain. In the future, after eliminating the above problems, tokenization can replace the traditional way of representing the value of physical assets – securities.

As technology becomes more sophisticated every year, the demand for it grows exponentially. Blockchain simplifies the life of the consumer in corporate, private and public, and in all other areas. Being a blockchain innovation agency, our field of performance is diverse: we conduct smart contract audits, provide blockchain advisory services, help launch tokenization platforms and make profits on DeFi. Applicature will help you skyrocket your blockchain project!

4 Secrets to Building a Successful Crypto Company

4 Secrets to Building a Successful Crypto Company

NFT Marketplace on Blockchain can be a Promising investment choice

NFT Marketplace on Blockchain can be a Promising investment choice

How Cryptogenic NFTs and NFT artworks on Blockchain are transforming the creative and digital art world

How Cryptogenic NFTs and NFT artworks on Blockchain are transforming the creative and digital art world

Migrating projects to Binance Smart Chain (BSC)

Migrating projects to Binance Smart Chain (BSC)